Medicare Advantage plans are a masterclass in pulling the wool over the public’s eyes through deceptive advertising, hijacking the trusted “Medicare” name, and benefiting from billions of lobbying and campaign dollars. They’ve been so successful in their sneaky tactics that many Americans believe Medicare Advantage is a government-run program, just like Medicare.

In truth, Medicare Advantage plans are all run by private insurance corporations, and all have the ultimate goal of enriching shareholders, not helping patients and providers. And of course, they do this all on our dime, since their profits come from federal funds.

For rural hospitals, the unchecked power of Medicare Advantage insurers is an existential threat. These private insurance giants reject basic claims for services automatically covered by Medicare, slash payments for treatments they do cover, impose endless administrative hoops, and drown hospitals in unnecessary appeals, knowing full well that many won’t have the resources to keep fighting. Meanwhile, these costly and poorly-covering plans cost taxpayers 22% more than traditional Medicare, to the tune of $83 billion per year.

Simply put, Medicare Advantage is lining corporate pockets while gutting rural healthcare access.

They’re doing this out in the open, with no real oversight.

And no one in power seems to be doing anything about it, probably because the insurance lobby has spent billions ensuring they don’t.

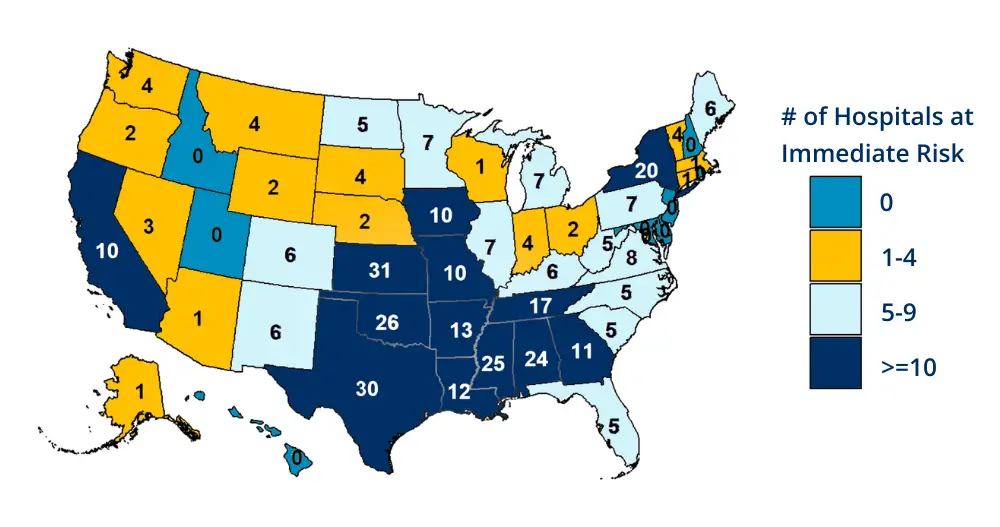

Right now, more than 700 rural hospitals across the country are in danger of closing, largely as a result of these predatory plans and policies (over 300 are at “immediate risk,” or within 2-3 years). As noted, MA pays hospitals far less than traditional Medicare, while the number of patients on these plans keeps growing every year. As more enrollees shift to MA, hospitals are making less and less money for the same services, unable to keep up with rising wages, inflationary costs, and the increasing expense of delivering care.

Of course, this isn’t by accident. The profiteering is an intentional strategy by insurers to maximize profits while forcing hospitals to absorb the losses. And unless something changes, the consequences for rural communities will continue to be devastating.

In rural America, losing a hospital means losing the only emergency care for miles. Patients experiencing heart attacks, strokes, or severe injuries are forced to travel hours to get the care they need.

The problem goes even further, with huge rippling effects. When a rural hospital disappears, so do obstetrics services, cancer treatments, mental health care, and routine medical visits. Specialists stop coming. Primary care doctors leave. The town itself suffers as jobs disappear and families move elsewhere.

No problem, though, as long as corporate insurers keep making their profits, right?

Platte Health Center Avera in South Dakota is one of many rural hospitals fighting to survive under these conditions. CEO Mark Burket has seen firsthand how Medicare Advantage insurers bleed hospitals dry through reduced payments, as well as by forcing hospitals into a relentless cycle of denied claims and appeals.

“I think it’s part of the strategy of these companies to basically tire the industry out,” Burket says. “Or have hospitals decide that fighting the denials isn’t worth it, especially on lower-dollar claims.”

It’s a strategy that works. Hospitals, especially those in rural areas, operate on razor-thin margins. They don’t have the time or staff to fight every wrongful denial, so they’re forced to write off losses. And every year, the financial strain worsens.

Meanwhile, Medicare Advantage enrollment keeps climbing. More patients, more denials, more appeals, more losses. It’s an unsustainable cycle that is actively driving hospitals toward closure.

There is a simple legislative change that would go a long way toward holding insurers accountable and keeping hospital doors open.

Will Congress act, or will they just keep shoving lobbying dollars into their overflowing pockets?

Traditional Medicare has Medicare Administrative Contractors (MACs) that enforce rules, ensure timely payments, and stop bad actors.

These private contractors operate under federal jurisdiction and oversight, processing Medicare Part A and Part B claims for hospitals, doctors, and other providers. MACs ensure accurate reimbursements, conduct medical reviews, and oversee appeals, holding providers accountable while also making sure they aren’t unfairly denied payment. MACs prevent fraud, reduce improper billing, and make sure hospitals and doctors receive fair, timely reimbursements for the care they provide.

If traditional Medicare is so tightly regulated, why are corporate-run Medicare Advantage plans allowed to run wild, with no oversight and no consequences?

Insurers dictate their own rules, delay payments at will, and deny necessary care with zero consequences. There’s no independent body ensuring fair play, no standardized process for appeals, and no accountability for wrongful denials. It’s a rigged system where insurers profit while hospitals and patients suffer.

At the absolute least, we need to start holding Medicare Advantage plans to the same standards, rules, and regulations enforced on Medicare. Can you think of a single reason why not?

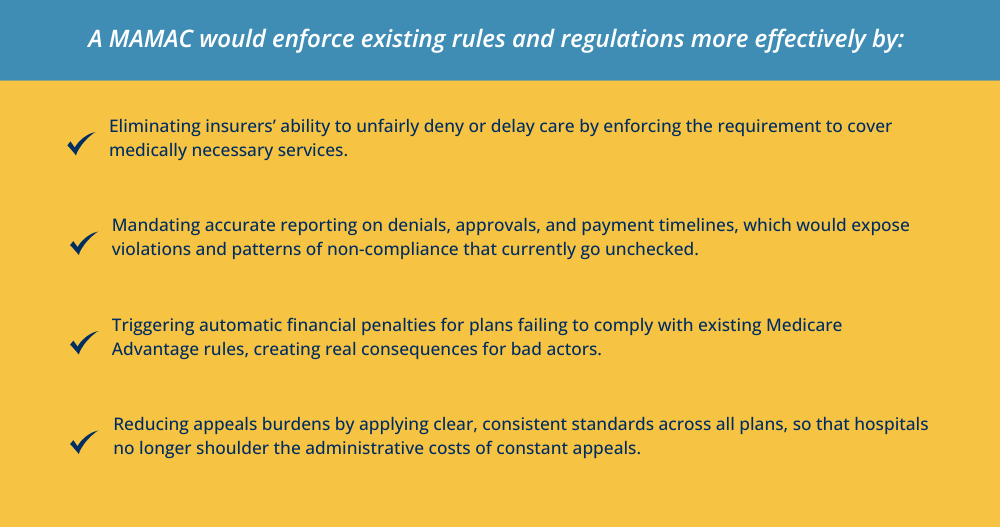

We need a Medicare Advantage Medicare Administrative Contractor (MAMAC) – a dedicated oversight body to enforce the same standards on MA insurers that MACs already apply to traditional Medicare.

A Medicare Advantage Medicare Administrative Contractor (MAMAC) would serve as an independent oversight entity, bringing much-needed regulation to Medicare Advantage plans.

This would finally put an end to the lack of accountability that allows private health care insurers to collect taxpayer dollars while dictating payments, denying care, and delaying reimbursement without consequence.

It would further create consistency in claim processing, reducing unnecessary denials, and enforcing transparency. Under this model, MA plans would still pay providers according to their negotiated contracts, but an independent MAMAC would ensure compliance with existing Medicare Advantage regulations and prevent bad-faith denials.

Medicare Fee-for-Service has long had safeguards in place to ensure fair payments. We need to insist that Medicare Advantage finally plays by the same rules.

Why should private insurance corporations continue to be the beneficiary of billions of taxpayer dollars with almost no oversight?

Medicare Advantage is bleeding rural hospitals dry, draining taxpayer dollars, and getting away with it. Insurers have rigged the system in their favor, and unless we demand change, they will continue to deny care, underpay providers, and erode healthcare access for millions of Americans.

Congress has the power to fix this. The question is, Will they?

If you care about rural healthcare, taxpayer waste, or simply holding corporate insurers accountable, now is the time to act. Here’s what you can do:

Read our full report to understand just how deep this crisis runs. Share it widely to bring more people to the cause.

Call or write your representatives and tell them you want real oversight for Medicare Advantage. Here’s a simple script you can use:

“I’m a concerned voter, and I want Congress to put an end to Medicare Advantage insurers profiting at the expense of hospitals and taxpayers. Rural hospitals are closing because private insurers underpay providers and deny care with no oversight. Traditional Medicare is required to follow strict rules and is overseen by Medicare Administrative Contractors (MACs) to ensure fair payments and prevent fraud. Why should Medicare Advantage, which costs taxpayers more, not have to play by the same rules? We need a Medicare Advantage Medicare Administrative Contractor (MAMAC) to hold these insurers accountable. Will you support this?”

You can also see for yourself where your representative stands. Check OpenSecrets.org to find out how much money they’ve taken from insurance lobbyists. If they’ve pocketed millions from the industry, you deserve to know.

Medicare Advantage was supposed to be a cost-effective alternative, not a corporate cash grab. But ever since the passage of the Medicare Modernization Act in 2003, which opened the floodgates to MA plans, insurers have tipped the scales in their favor.

With the administration’s focus on rooting out waste and corruption, now is the time to demand fairness, accountability, and real oversight – before more hospitals shut down and more patients go without care.

The best place to connect with me